It could never happen to me or my family. It could never happen to you or your family. Our friends are also immune.

But in the case of elder abuse, those three statements are, sadly, far from the truth.

Another sad fact. More often than not, elder abuse victims know their assailants. Worse than that, chances are they are related to them or are people whom the victims trust.

Elder abuse is a deeply troubling and often hushed issue affecting millions of older adults locally, nationally and, I assume, worldwide. It is defined as any intentional or negligent act by a caregiver or trusted individual that causes harm or poses a serious risk of harm to someone aged 60 or older.

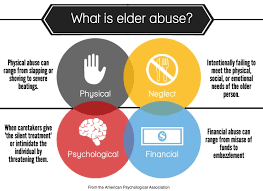

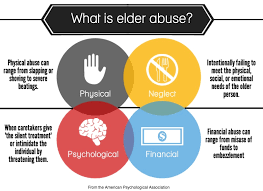

The website, www.seniorlist.com, states this mistreatment can take many forms, including physical abuse such as hitting or restraining; emotional abuse through threats, humiliation, or isolation; sexual abuse involving unwanted contact; financial exploitation through theft or manipulation of assets; and neglect – failing to meet basic needs such as food, hygiene, or medical care. Abandonment is another form of elder abuse.

Elder abuse can be hard to detect because it often occurs in private settings, committed by family members, caregivers, or others in positions of trust. Many cases go unreported due to fear, shame, or the victim’s inability to seek help.

I found this statistic unbelievable. According to www.theseniorlist.com, about 60% of elder abuse cases are committed by family members, most often spouses, adult children, or grandchildren. And in many of those cases, multiple types of abuse occur simultaneously, such as emotional or physical abuse paired with financial exploitation.

It’s not just the phone scammers taking advantage of the senior population. No. In most cases it is a member, or members, of their own family. The people they brought into the world. The people they raised into adult humans are now repaying them by abusing them physically or by stealing from them. Oftentimes they are caught because they go back to the well once too often. Financial institutions such as banks and credit unions may become suspicious of activity in their senior customer’s accounts and begin investigating the unusual activity.

The “honest” friends and caretakers while visiting those being victimized may notice changes in the senior victim’s appearance and attitude – maybe they’re not as outgoing as before, timid, and possibly signs of bruising from being grabbed or struck.

Emotional abuse – also called psychological abuse – includes behaviors like yelling, belittling, bullying, isolating, or threatening the older adult. It’s often subtle and harder to detect, but it can deeply affect the victim’s mental health and sense of safety.

Another sickening scenario is when financial professionals in care facilities, whether it is assisted living or long-term care, figure out ways to manipulate additional payments from insurance companies to pad their personal pockets.

If you have a senior in a care facility, go see them on a regular basis and make sure the personnel know you are there. I can tell you from experience that those who have regular visitors are very well cared for. The facility is aware you will be coming, and they will be on its best game.

Children and grandchildren can play on senior’s emotions to be added to their bank accounts. “Grandma, my car payment is due, and my check won’t be here until Thursday. Can I borrow your debit card? I promise I will pay you back.” Before they know it, they are contacted by the bank because they are overdrawn.

Physical or, worse yet, sexual abuse of an elder should, in my opinion, warrant automatic prison time. Don’t even bother with a trial. That’s as bad as abusing a child. In most cases, these are helpless victims.

One of the more popular threats to seniors today is convincing calls from the phone scammers. They are very good at making them believe they have a serious problem – whether it is your Social Security number has been compromised or if you don’t pay your back taxes over the phone today, the Sheriff will arrest you after we hang up.

Financial abuse involves the misuse or theft of an elder’s money, property, or assets. This might include tricking them into changing legal documents, stealing funds, or manipulating them into giving away resources.

Sadly, this happened to a senior my wife and I knew very well, and it pushed him over his mental boundaries. He felt obligated to buy one of his granddaughters a small house (and pay her utilities) because she convinced him she could no longer live at home with her mother. He was mentally defeated. This was after he set her up with a car.

This was the beginning of the end for him.

It happens. It happened. And it can happen close to home. If you’re a caretaker for a senior, be vigilant in their appearance and their attitude. Does something seem off? Ask questions. You may be the one that saves them from being further victimized. Recognizing elder abuse and knowing how to respond can make a life-changing difference.

Here’s a breakdown to help you spot the signs and what action to take.

What to Do If You Suspect Abuse

• Talk to the elder

• Ask questions

• Document what you see

• Report it to the authorities

• Don’t confront the abuser alone

• Offer ongoing support

SOURCE: www.the seniorlist.com. www.consumeraffairs.com, www.nursinghomeabusecenter.com, www.justice.gov.

— Keith Lippoldt